Fraud Detection

Techniques & Applications

Dr. Sasha Göbbels

http://slides.technologyscout.net/fraud-detection/With commerce comes fraud.

Nathan Blecharczyk, AirBNB

Overview

- Definitions: what is fraud and how does it work?

- What methods are available?

- What do the operational scenarios look like?

- What is the optimal approach?

Definitions

What is fraud?

Fraud is deliberate deception to secure unfair or unlawful gain, or to deprive a victim of a legal right.

Wikipedia

What is fraud detection?

- Areas of application

- Transactions in online banking and creditcards

- Claims with insurances and warrenty

- Call records with telco providers

- Data is fed in parallel into live system and fraud detection system

- When the alarm goes:

- Transactions are denied or put on hold

- Claims are marked for manual inspection

Methods

Methods of fraud detection

1. Rule based systems

|

2. Graph based systems

|

3. Expert systems

|

4. Deep learning

|

1. Rule based systems

Overview

|

|

1. Rule based systems

Background

-

Components:

- in-memory database

- rules engine

-

Data:

- detail data of each transaction

- aggregated data (e.g. average monthly volume of transactions of creditcard)

1. Rule based systems

Pros & cons

| Pro | Contra |

|---|---|

|

|

2. Graph based systems

Overview

|

|

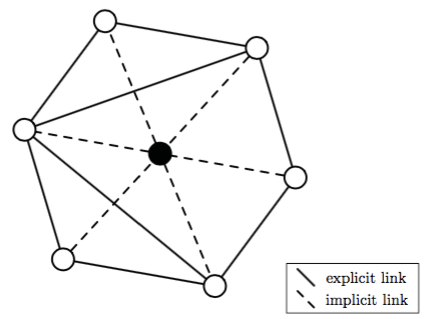

2. Graph based systems

Background

-

Components:

- graph based or relational database

- data mining algorithms

- visualization

- mathematical foundation: graph theory

2. Graph based systems

Pros & cons

| Pro | Contra |

|---|---|

|

|

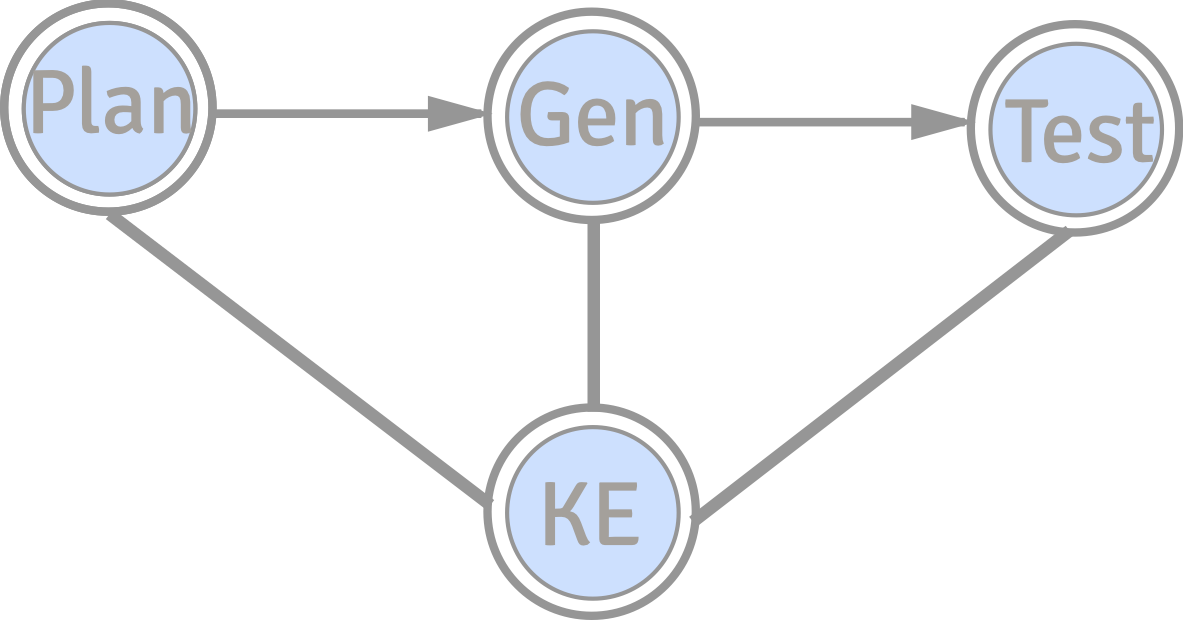

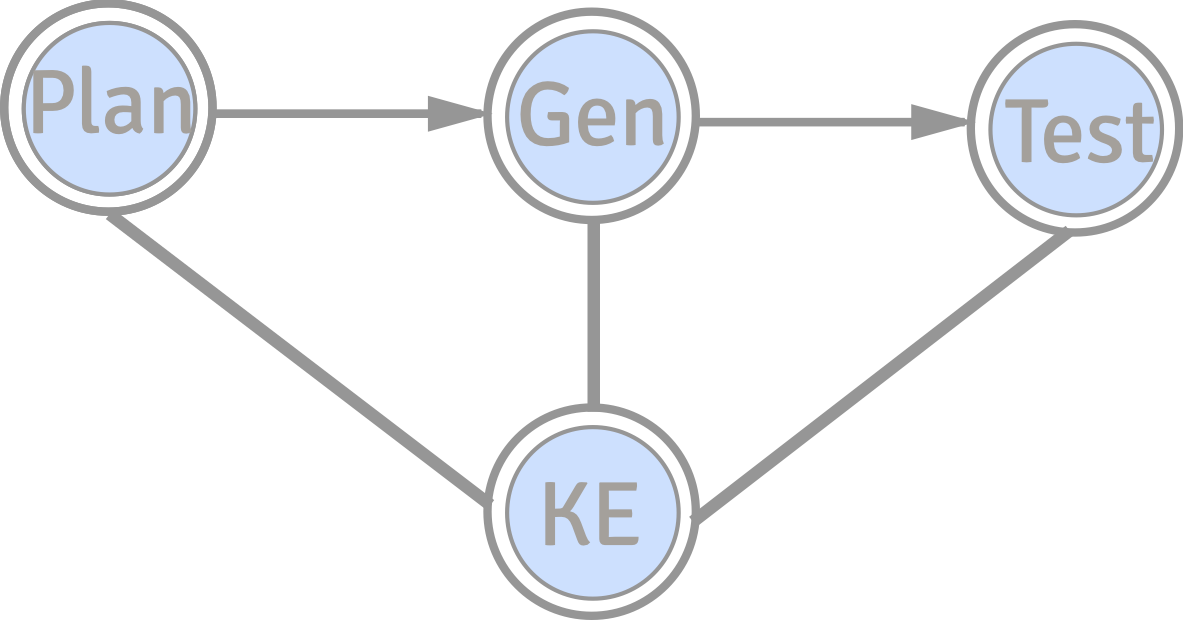

3. Expert systems

Overview

|

|

3. Expert systems

Background

|

|

3. Expert systems

Pros & cons

| Pro | Contra |

|---|---|

|

|

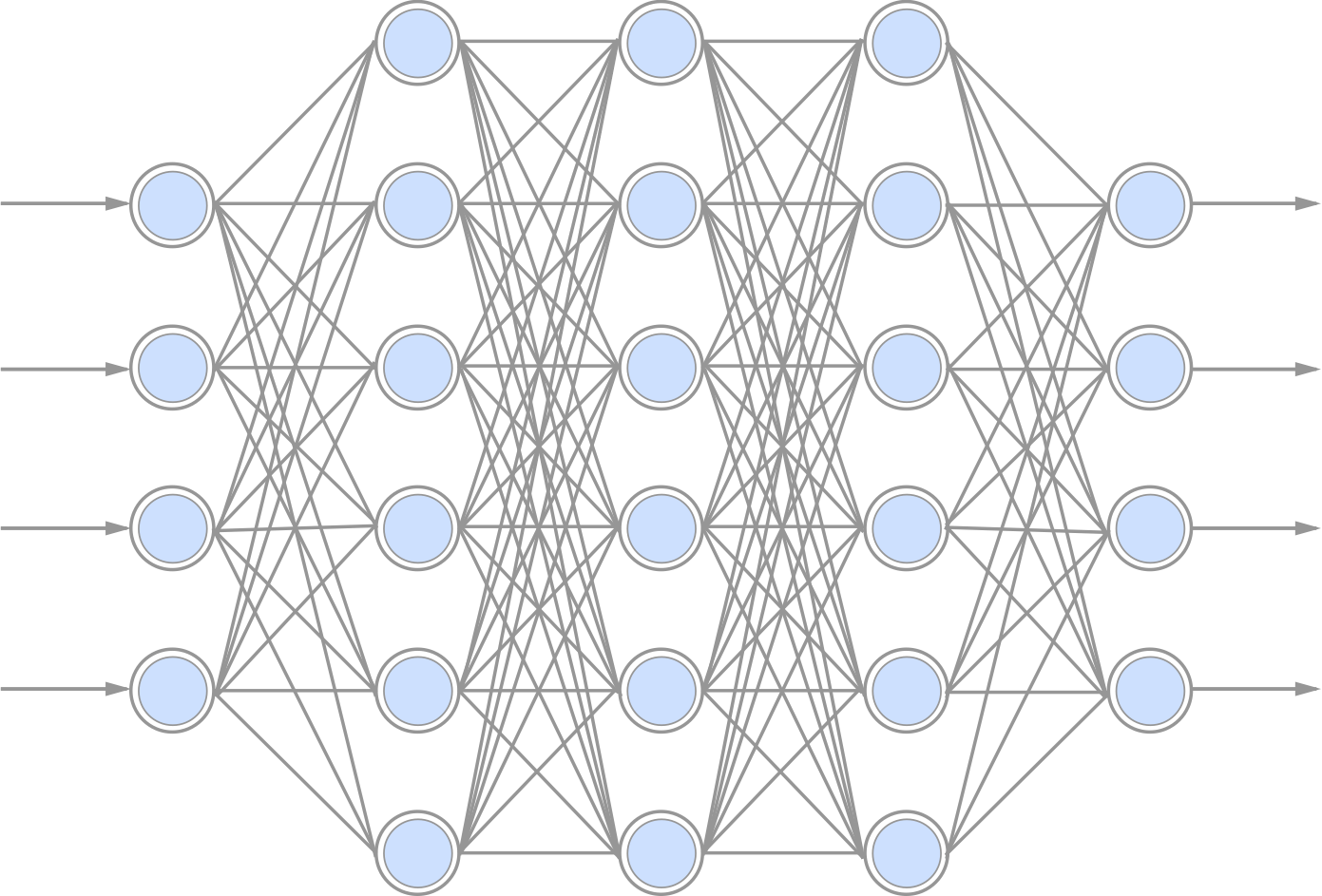

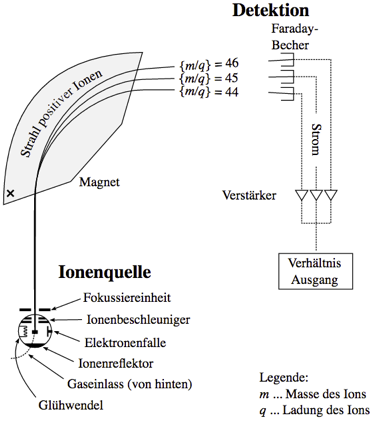

4. Deep learning systems

Overview

|

|

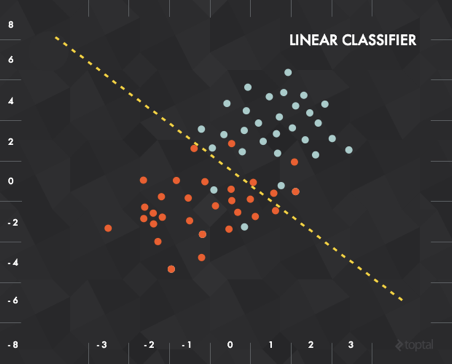

4. Deep learning systems

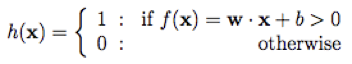

Perceptron

|

|

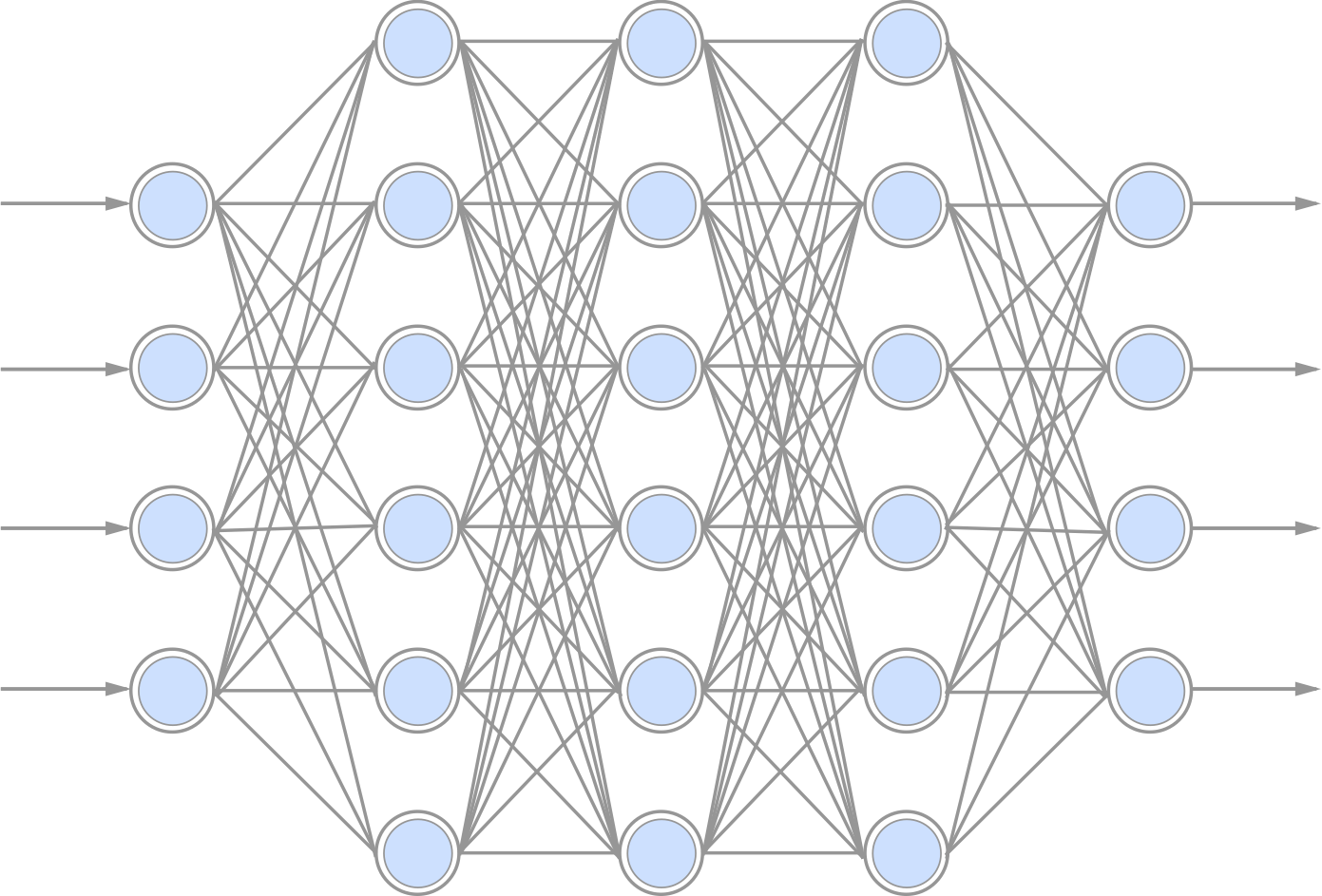

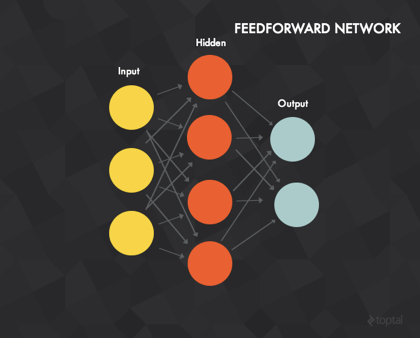

4. Deep learning systems

Many perceptron

|

|

4. Deep learning systems

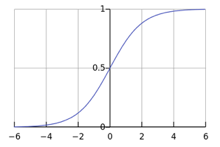

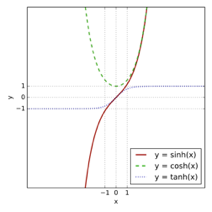

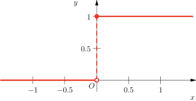

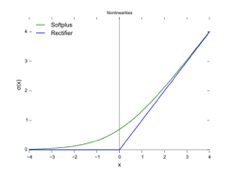

Activation functions f(x)

A linear combination of linear functions f(x) still results in a linear functionBack door: use non linear functions!

4. Deep learning systems

Activation functions f(x)

signoid/logistic function |

hyperbolic tangens |

Heaviside function |

rectifier/softplus function |

4. Deep learning systems

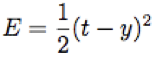

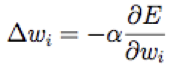

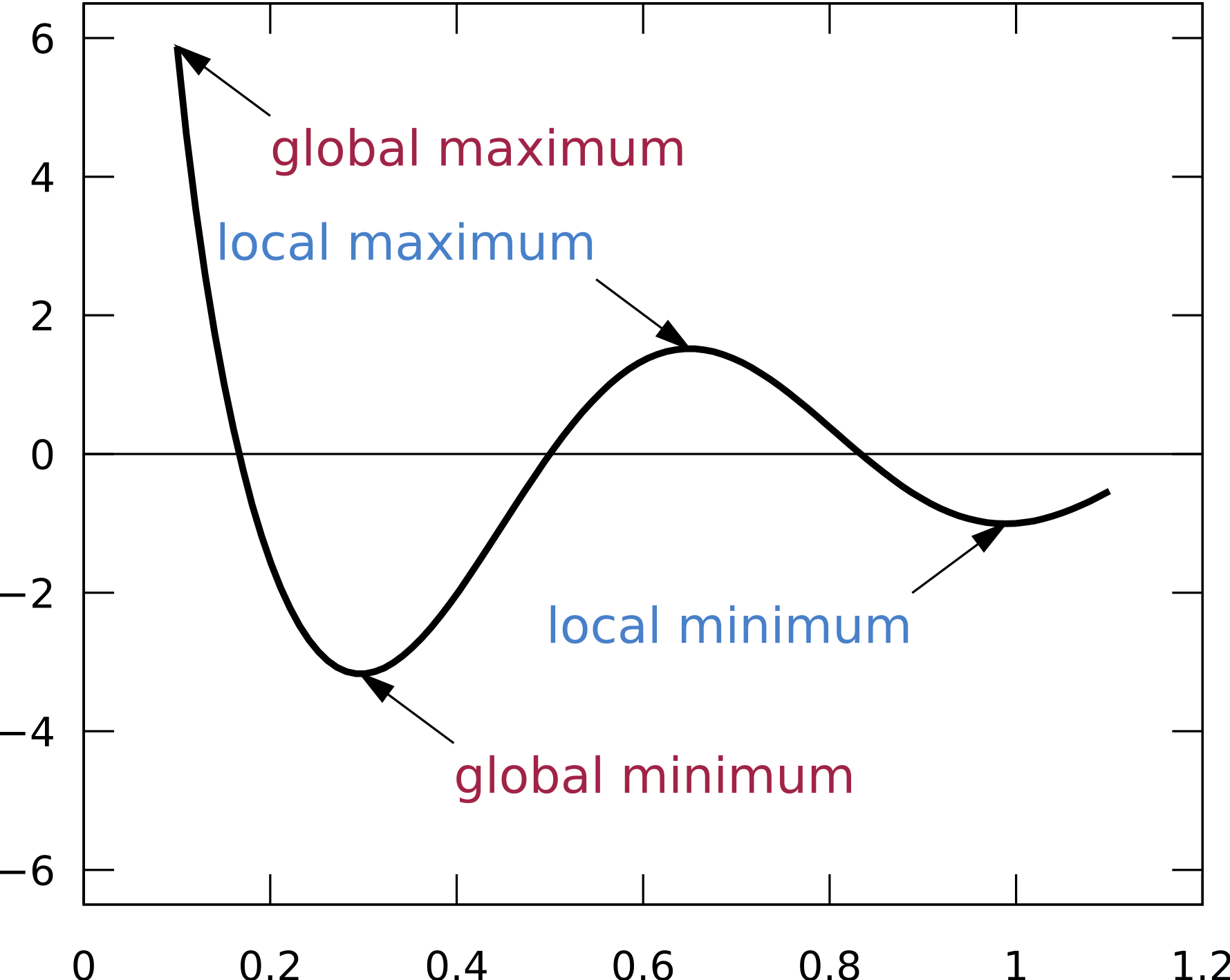

Training is everything!

|

|

4. Deep learning systems

Pros & cons

| Pro | Contra |

|---|---|

|

|

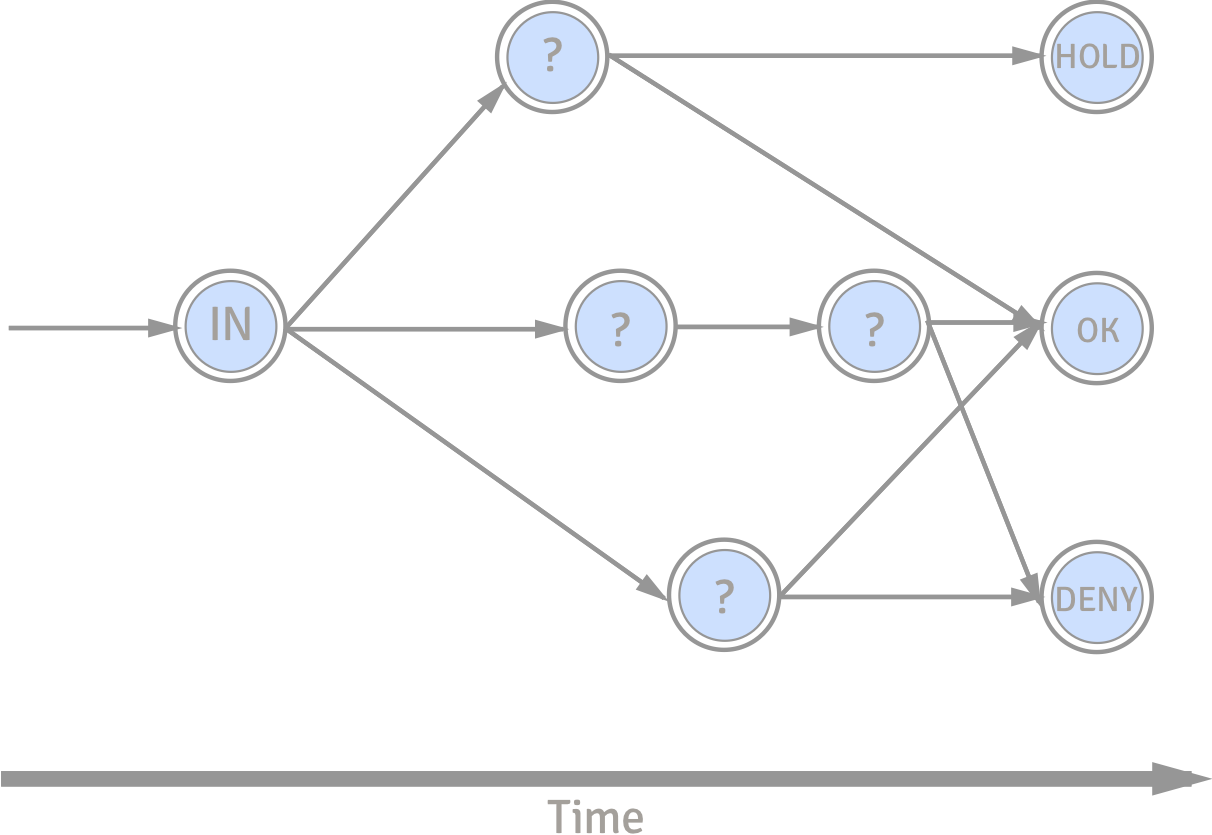

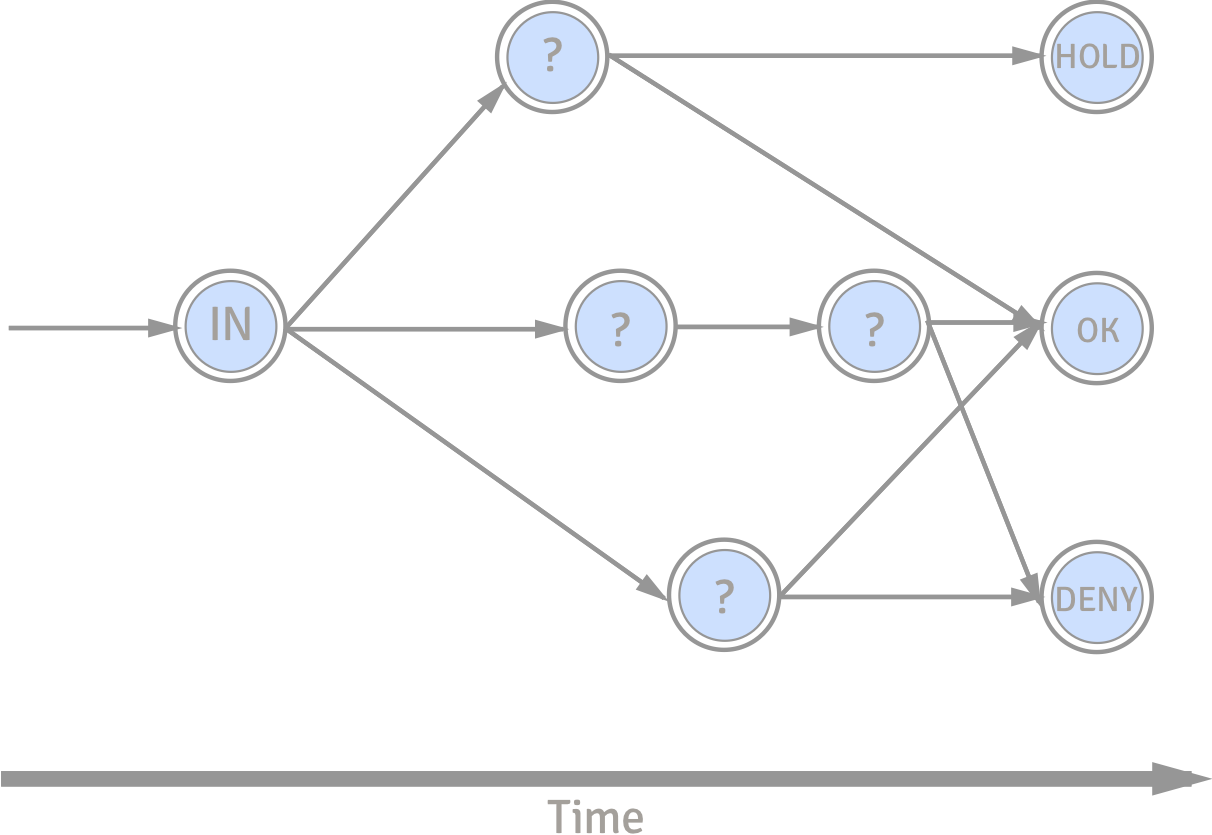

Operational scenarios

Example 1: Social security fraud in Belgium

How does it work?

|

|

Example 1: Social security fraud in Belgium

The problem

- around 250.000 active companies in Belgium in 2012

- in the long run 25% of them will become insolvent

- only very few of those are fraudulent

- aim: detect critical cases before they become broke

Example 1: Social security fraud in Belgium

The solution

- graph theory: ego networks → elimination of inconspicuous companies

- training data: enrichment of fraudulent cases by SMOTE (synthetic minority oversampling technique)

- 2 data scenarios:

- basic (only local information of the node)

- relational (plus infos of resources from the ego net)

- remainder goes into neural network

- random forest

- naive Bayes

- logistic regression

Example 1: Social security fraud in Belgium

Results

- random forest delivers best results

- AUC (area under curve) ROC (receiver operating characteristic) selectivity between fraud and non-fraud: 85-88%

- important: temporal analysis after 6, 12 or 24 months. ROC AUC goes down. True positives go up.

Example 2: Fraud in mobile networks

How does it work?

Typical example:- fraudster signs subscription with mobile carrier

- fraudster sells usage of his subscription to others for long distance calls

- fraudster vanishes when payment is due

Example 2: Fraud in mobile networks

The solution

- define scenarios

- extract indicators for fraud from scenarios

-

accumulated data from CDR (call detail record):

- IMSI (international mobile subscriber ID)

- start of call and duration

- number called

- type of call (national/international)

Example 2: Fraud in mobile networks

Details

- what for one account is an "atypical usage" is quite normal for another one

- solution: differential analysis per account via user profile history (UPH) and curent user profile (CUP): $U_{now} = (1 - \alpha) UPH_{old} + \alpha CUP$

-

goes into:

- rule based white box system

- supervised neural network (multilayer perceptron with 1 hidden layer, logistic-sigmoidal activation function)

- 2 unsupervised neural networks (A-numbers: user profile; B-number: monitoring target country of call)

- combination of all 4 alarm function/fraud scores

Example 2: Fraud in mobile networks

Results

- AUC ROC selectivity for test data: 87.2%

- AUC ROC selectivity for real data: 85.6%

Optimal approach?

The future is bright and complex

- parallel circuit: combination of several detection methods can lead to better results

- series connection: elimination of unsuspicious cases via method 1, scoring with method 2

- derivation: generate rules with method 1, application and scoring with method 2

Dr. Sasha GöbbelsTechnologyScoutInnovation management Fraud detection Team management eCommerce consulting |

References

- W. McCulloch, W. Pitts, „A Logical Calculus of the Ideas Immanent in Nervous Activity“, Bulletin of Mathematical Biophysics, Vol. 5 (1943), pp. 115-133

- A. Rosenblueth, N. Wiener and J. Bigelow, „Behavior, Purpose and Teleology“, Philosophy of Science, Vol. 10, No. 1 (Jan., 1943), pp. 18-24

- V. Van Vlasselaer, B. Baesens, et. al., „Using Social Network Knowledge for Detecting Spider Constructions in Social Security Fraud“, ASONAM’13 (2013 IEEE/ACM International Conference on Advances in Social Networks Analysis and Mining), pp. 813-820

- N. V. Chawla, K. W. Bowyer, Lawrence O. Hall, W. Ph. Kegelmeyer, „SMOTE: Synthetic Minority Over-sampling Technique“, Journal of Artificial Intelligence Research, Vol. 16 (2002) pp. 321–357

- H. Verrelst, E. Lerouge, Y. Moreau, J. Vandewalle, Chr. Störmann, P. Burge, „A rule based and neural network system for fraud detection in mobile communications“, European project “Advanced Security for Personal Communication Technologies” (ASPeCT)

- T. Fawcett, F. Provost, „Adaptive Fraud Detection“, Data Mining and Knowledge Discovery, Vol. 1 (1997), pp. 291–316